Why Does the Federal Reserve Print Money Continuously Quizlet

The S&P 500 declined 5.89% last Thursday, which was the worst drop since March 16.

Source: Shutterstock

Understandably, it put traders on edge. Our tentative estimate was that stocks were likely to drop to the 2,900 range on the S&P 500. It turns out our caution was too conservative, and the market rallied for three sessions before a softer day on Wednesday.

Our strategy of buying back our short calls on dips (as we did on June 12 and June 15) and then selling again on the highs (which we did on June 16 and June 17) should be very profitable if traders continue to buy the dips like they did this week.

How Does the Federal Reserve Fit In?

Underwriting that strategy is a Federal Reserve that has pulled out all the stops to buy corporate and government debt.

Source: Chart by TradingView

Daily Chart of the S&P 500 (SPX)

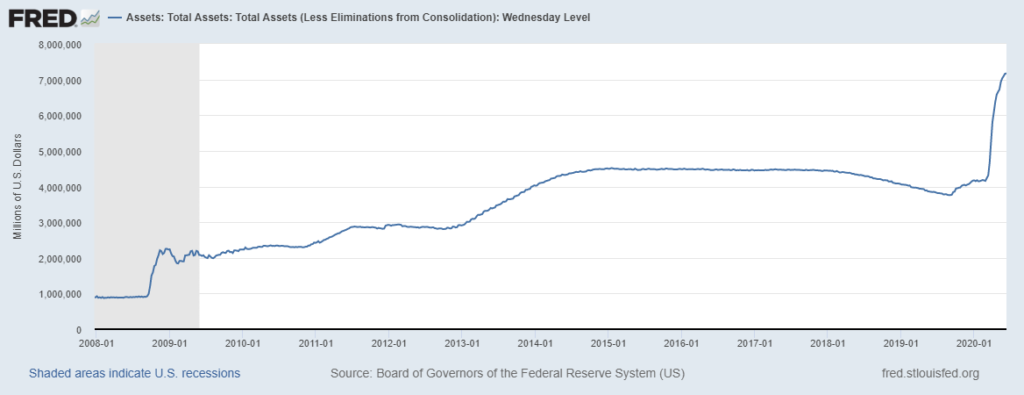

As you can see in the following chart, the Federal Reserve has expanded its balance sheet to more than $7 trillion in assets. Three trillion dollars of that were purchased after February.

That means the Fed has "printed" $7 trillion in dollar supply to go on that spending spree, which doesn't seem to be worrying any traders yet. But it could create some serious long-term risks of inflation.

Source: Chart by St. Louis Federal Reserve

Federal Reserve's Total Assets

Investors seem willing to buy stocks if the Federal Reserve is supporting the corporate debt market. And in the short term, that's exactly what the central bank is doing.

We are concerned about the long-term viability of this strategy, but for now, we don't want to fight the Fed by betting against that strategy. Frankly, if investors do get a little more wary, it should increase short-term volatility, which we expect to increase option premiums and allow us to roll out our trades more often.

Are we likely to see some profit-taking?

While the Fed's support and the recent rebound in retail spending have done a lot to bring prices back up, it's reasonable to think about what happens if more traders start taking profits off the table at this point.

While we can't predict the timing for that with exact precision, there are a few helpful indicators that should give us some warning.

The CBOE SKEW Index

As we have mentioned in previous updates, the CBOE SKEW Index (SKEW) helps us understand whether large traders are hedging their positions through long, out-of-the-money puts on the S&P 500 cash index.

In our studies, this indicator is most accurate when it is rising in tandem with the market. A rising SKEW indicates rising fear. And in our view, this is the most worrisome short-term indicator right now.

As you can see in the following chart, the SKEW is currently very elevated. Although not quite as high as it was on the last day the market rallied in February, it is well above its historical average.

From a strategic perspective, this justifies a more aggressive approach to selling calls against long stock positions as a hedge and source of income, which has been our focus so far this week.

Source: Chart by TradingView

Daily Chart of the CBOE SKEW Index (SKEW)

A Stronger Dollar

As the Federal Reserve has been flooding the market (or, at least, the banks) with dollars, the value of the greenback has come down off its March highs. However, last week, the dollar hit long-term support and has been moving higher once again.

The dollar is used as a hedge against uncertainty by domestic and international investors. A change in capital flow — with investors taking profits and pushing back into safe asset classes — could push the dollar toward its March highs. And any more progress toward the March highs would indicate a negative shift in sentiment.

From a technical perspective, we expect support for the dollar index near $96 to hold, but that doesn't concern us as long as resistance at $98 isn't broken. If we see more upside into the $99-$100 range, then we may want to adjust our strategy further and trade even more conservatively.

Source: Chart by TradingView

Daily Chart of U.S. Dollar Index Futures

Relative Performance of Risky Assets

The strength of a bull market is often signaled by the relative performance of risky assets compared to more conservative assets. A classic example of this is large-cap stocks, as represented by the S&P 500, and small-cap stocks, as represented by the Russell 2000. If traders are bullish, small-caps should perform relatively better than large-caps.

But sometimes the opposite is true. A warning sign for a weak rally and a sharp correction is when investors prefer the safer, more conservative large-cap stocks, even if the market is rising on average.

As you can see in the following chart, as the S&P 500 was rising before the Covid-19 crisis, small-caps were underperforming. The line below the price chart represents the relative performance of small-caps versus large-caps. When this line falls, it means investors are shifting away from small-caps. This indicates a weak rally.

Source: Chart by TradingView

Daily Chart of the S&P 500 (SPX) with RUT/SPX Comparison Chart

The relationship between the risky small-caps and more conservative large-caps has been erratic, but much more positive since the market bottomed in April. This is a good sign, and watching this indicator should give us a leading signal of any further weakness or profit-taking.

If the trend of the relative-performance line turns negative, we should consider that a trigger for a more cautious short-term outlook.

The Bottom Line

There has been some good headline news for the market over the last few days. Retail sales for May were much better than anticipated because consumers spent more after quarantine measures were loosened.

Earlier this week, the Empire State manufacturing report also showed a surprising rebound. And last Friday's University of Michigan Consumer Sentiment Index showed that sentiment among consumers was much "less bad" than originally expected.

So, although rising Covid-19 infection rates in the U.S. and China are certainly a concern, we still feel that most indicators are pointing toward a solid floor under the market that will slow any potential profit-taking or bearishness.

The pace of the recovery after the crisis may not be quite as fast as everyone would have hoped, but our strategy right now is to continue opening new bullish positions at support levels and rolling our short calls when prices dip.

John Jagerson & Wade Hansen are just two guys with a passion for helping investors gain confidence — and make bigger profits with options. In just 15 months, John & Wade achieved an amazing feat: 100 straight winners — making money on every single trade . If that sounds like a good strategy, go here to find out how they did it . John & Wade do not own the aforementioned securities.

Source: https://investorplace.com/2020/06/make-money-courtesy-of-the-federal-reserve/

0 Response to "Why Does the Federal Reserve Print Money Continuously Quizlet"

Post a Comment